PANDEMIC

Lost Lives: An Alternative Perspective

We judge the success of countries and states battling the COVID-19 disease by numbers of cases and deaths. But some researchers say we may be looking through the wrong end of the telescope. One country, Sweden, has 100 times New Zealand's death rate per capita but a number of research scientists are beginning to think Sweden may, in the long run, achieve herd immunity losing fewer lives than countries that sacrificed their social life and economy to quell the spread of the disease.

The media has focused on the enemy we most fear, the coronavirus. The less-publicized enemy is the devastation caused by a strict lockdown. People die from social isolation and the stresses of a devastated economy.

No one knows how many lives the second enemy has taken but a subjective estimate can be conceptualized from the list of reported excess deaths from lockdown: Suicide, substance abuse, missed chemotherapy appointments (down 50%), reduced cancer screenings (down 75%), domestic violence, and the list goes on.

The World Health Organization (WHO) surveyed 155 countries to determine the extent of excess deaths from neglecting non-communicable diseases (NCDs) due to lockdowns. WHO reported the following.

"More than half of the nations reported that services for NCDs have been partially or completely disrupted, while two-thirds said rehabilitation services were affected.

Meanwhile, a staggering 94 per cent of countries have had to partially or fully re-assign health ministry staff working on NCDs to support COVID-19 response.

Screening campaigns - for breast and cervical cancer, for example - were also postponed in more than half of countries."

Eventually, we will have statistical evidence of short and long term death rates both with and without lockdown. In the meantime, Dr. Michael Levitt provides some insight using mathematical models giving us food for thought.

Levitt readily acknowledges he is not an epidemiologist, he is a biophysicist and a professor of structural biology at Stanford University. His mathematical modeling however extends well beyond biology. More generally, he employs mathematical models to decode and better understand what we observe when something is too complicated to disentangle from what is known about a system. His mathematical skills helped him win a Nobel Prize in Chemistry in 2013.

Levitt did not set out to compare deaths due to lockdown versus allowing herd immunity to run its natural course. He started by recording daily COVID cases in January of the pandemic in China. On January 31 he noticed that there were 46 new deaths compared to 42 the day before (consistent with exponential growth). He soon recognized that the disease initially increases exponentially, then the exponential growth begins to slowly decline towards zero where the curve representing the total number of cases flattens. He then predicted China's COVID-19 cases would peak at 80,000 cases and decline thereafter. (On June 2nd China appears to have peaked at 84,102 cases and is declining, a remarkably accurate prediction.) This pattern seemed to be consistent whether a country locked down or remained open. He applied his model to other countries including New Zealand.

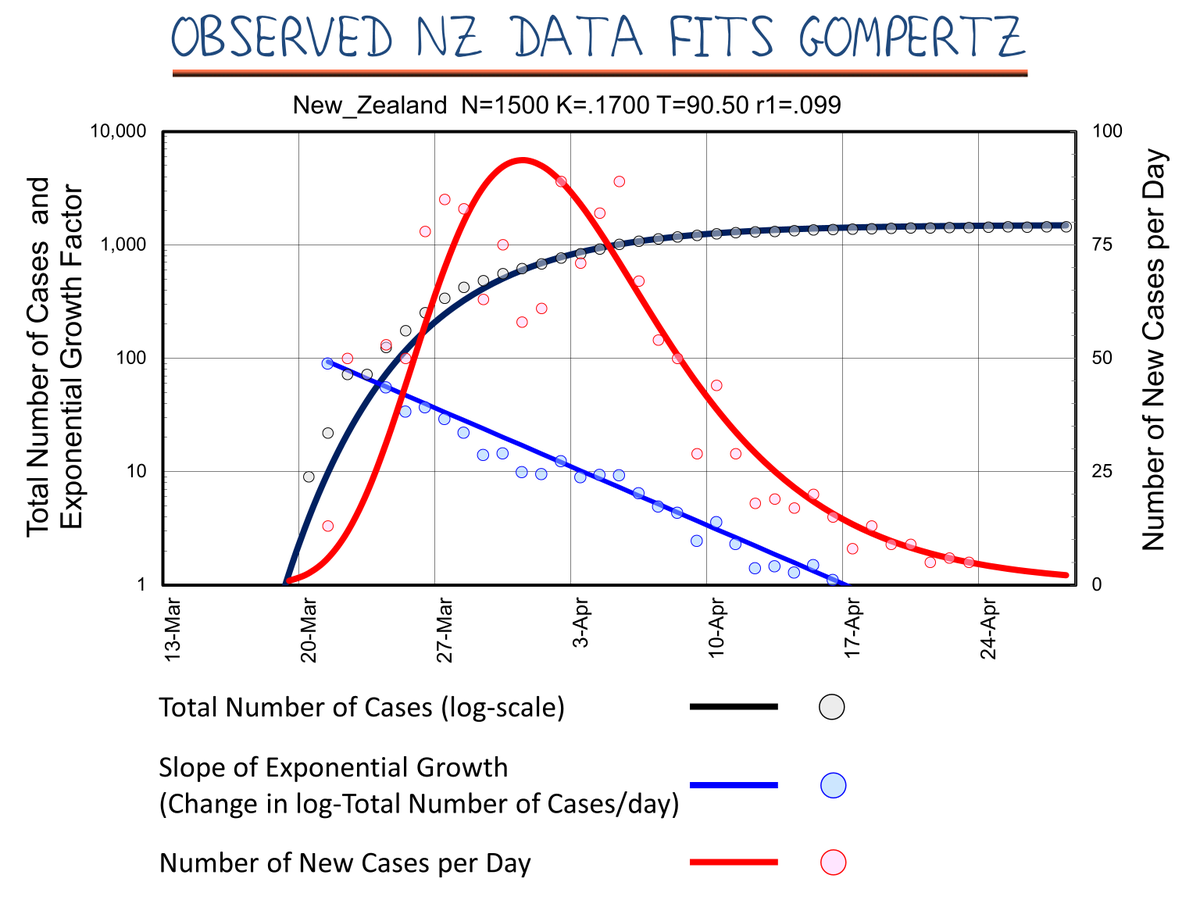

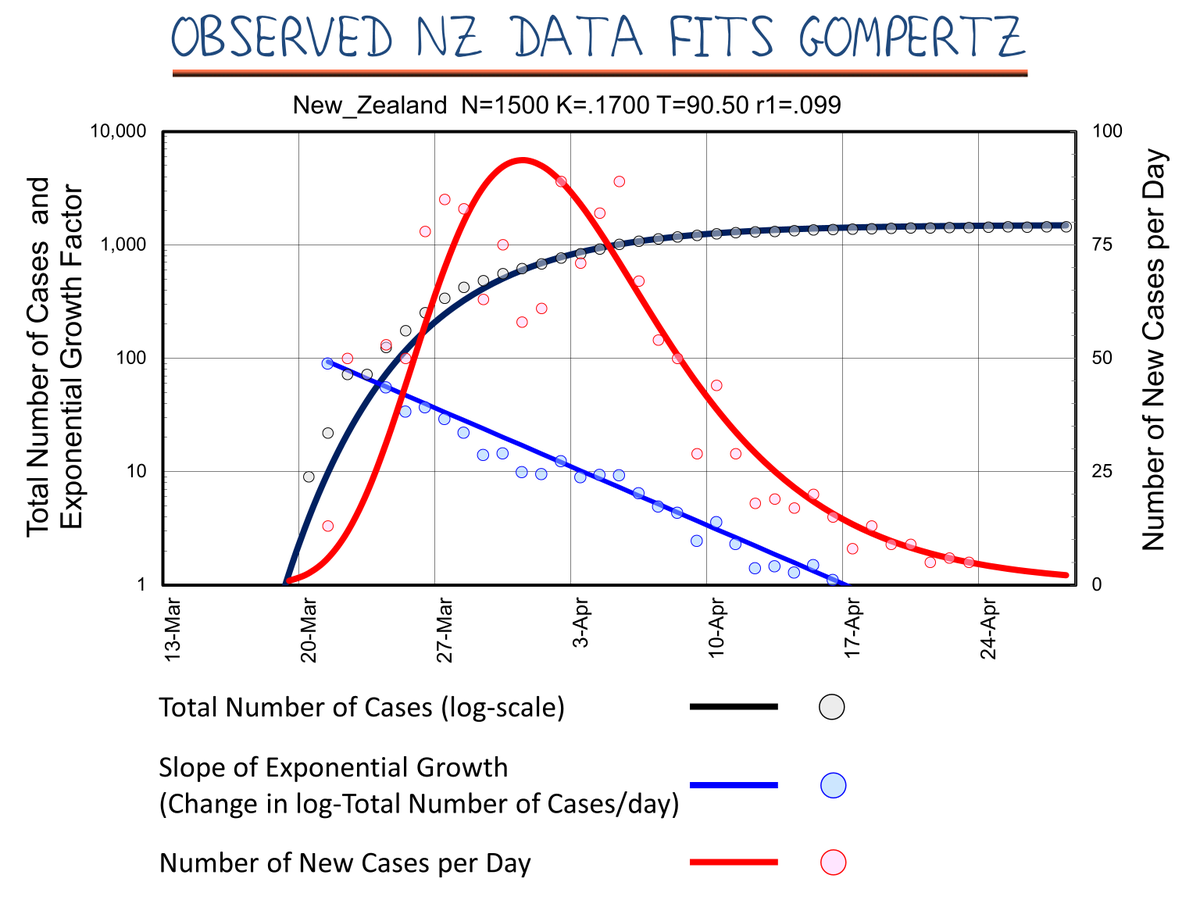

New Zealand acted "hard and early" in the words of the Prime Minister and brought the pandemic to a stop by locking down and isolating from the rest of the world. Each day the exponential growth rate declined linearly towards zero (the blue line in the graph) at which point the curve flattens (black line) and the new cases quickly die out. Levitt later came to two conclusions. The pandemic will be over sooner than predicted and the herd immunity threshold is substantially lower than the 60% or so estimated by epidemiologists.

For a more technical understanding of Levitt's models and a discussion of his tentative predictions, view his three short video talks in order - (one, two, three).

Regarding the question whether a strict lockdown or a rapid opening loses more lives, Levitt did conclude in a recent interview expressing his current opinion: "There is no doubt in my mind that when we come to look back on this, the damage done by lockdowns will exceed any saving of lives by a huge factor."

The jury is still out on the issue but the prospect that Levitt is right cannot be ruled out. There is much we don't know about the disease but it is time to focus on how to relax lockdown restrictions while carefully navigating a path to a reasonably safe economic and social recovery.

No one knows how many lives the second enemy has taken but a subjective estimate can be conceptualized from the list of reported excess deaths from lockdown: Suicide, substance abuse, missed chemotherapy appointments (down 50%), reduced cancer screenings (down 75%), domestic violence, and the list goes on.

The World Health Organization (WHO) surveyed 155 countries to determine the extent of excess deaths from neglecting non-communicable diseases (NCDs) due to lockdowns. WHO reported the following.

"More than half of the nations reported that services for NCDs have been partially or completely disrupted, while two-thirds said rehabilitation services were affected.

Meanwhile, a staggering 94 per cent of countries have had to partially or fully re-assign health ministry staff working on NCDs to support COVID-19 response.

Screening campaigns - for breast and cervical cancer, for example - were also postponed in more than half of countries."

Eventually, we will have statistical evidence of short and long term death rates both with and without lockdown. In the meantime, Dr. Michael Levitt provides some insight using mathematical models giving us food for thought.

Levitt readily acknowledges he is not an epidemiologist, he is a biophysicist and a professor of structural biology at Stanford University. His mathematical modeling however extends well beyond biology. More generally, he employs mathematical models to decode and better understand what we observe when something is too complicated to disentangle from what is known about a system. His mathematical skills helped him win a Nobel Prize in Chemistry in 2013.

Levitt did not set out to compare deaths due to lockdown versus allowing herd immunity to run its natural course. He started by recording daily COVID cases in January of the pandemic in China. On January 31 he noticed that there were 46 new deaths compared to 42 the day before (consistent with exponential growth). He soon recognized that the disease initially increases exponentially, then the exponential growth begins to slowly decline towards zero where the curve representing the total number of cases flattens. He then predicted China's COVID-19 cases would peak at 80,000 cases and decline thereafter. (On June 2nd China appears to have peaked at 84,102 cases and is declining, a remarkably accurate prediction.) This pattern seemed to be consistent whether a country locked down or remained open. He applied his model to other countries including New Zealand.

New Zealand acted "hard and early" in the words of the Prime Minister and brought the pandemic to a stop by locking down and isolating from the rest of the world. Each day the exponential growth rate declined linearly towards zero (the blue line in the graph) at which point the curve flattens (black line) and the new cases quickly die out. Levitt later came to two conclusions. The pandemic will be over sooner than predicted and the herd immunity threshold is substantially lower than the 60% or so estimated by epidemiologists.

For a more technical understanding of Levitt's models and a discussion of his tentative predictions, view his three short video talks in order - (one, two, three).

Regarding the question whether a strict lockdown or a rapid opening loses more lives, Levitt did conclude in a recent interview expressing his current opinion: "There is no doubt in my mind that when we come to look back on this, the damage done by lockdowns will exceed any saving of lives by a huge factor."

The jury is still out on the issue but the prospect that Levitt is right cannot be ruled out. There is much we don't know about the disease but it is time to focus on how to relax lockdown restrictions while carefully navigating a path to a reasonably safe economic and social recovery.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/UTWQB3EBYJEUVCKIXFVOJA7YBA.JPG)